As the financial markets continue to evolve, so too do the tools that traders use to engage with them. Modern trading software has advanced significantly, offering traders more sophisticated features, improved usability, and faster execution speeds than ever before. These cutting-edge platforms are designed to cater to a wide range of trading strategies and goals, whether you’re a day trader, swing trader, or long-term investor. In this article, we will explore some of the key features that define the latest generation of trading software, with a particular focus on the tools and functionalities that can enhance a trader’s performance.

Why Choose Advanced Trading Software?

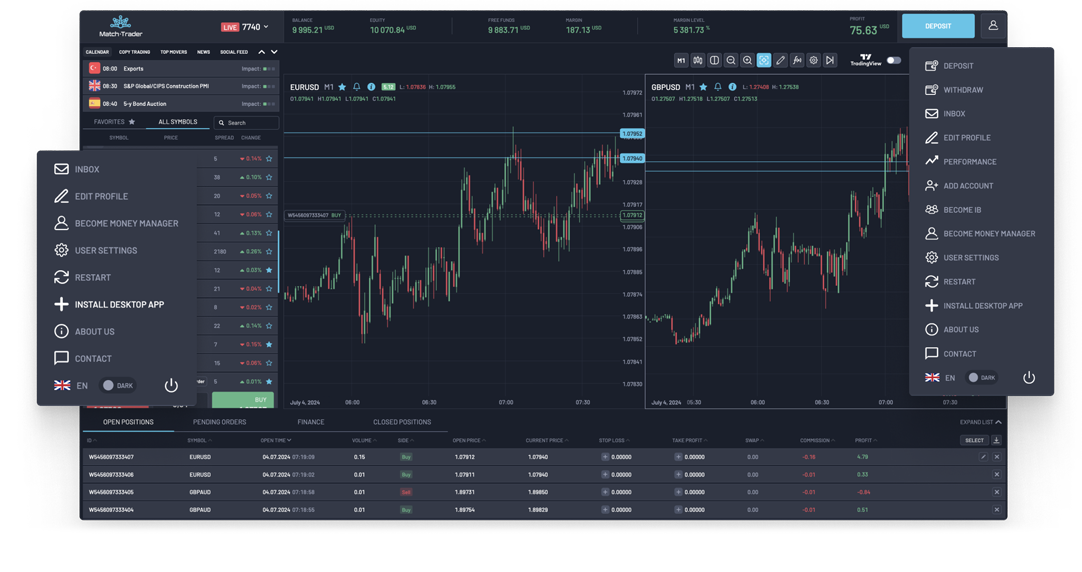

The right trading software can drastically improve your ability to make informed decisions and execute trades effectively. Platforms like Match-Trader are at the forefront of this shift, providing intuitive interfaces combined with powerful tools that cater to both beginner and advanced traders. These platforms prioritize speed, reliability, and ease of use, ensuring that users can execute trades quickly and efficiently while managing risks effectively.

A major benefit of modern trading software is its ability to integrate with other tools, offering traders a comprehensive solution that goes beyond just executing trades. From sophisticated charting and real-time data analysis to automated trading and advanced risk management, the possibilities are endless.

Advanced Charting and Technical Analysis

One of the most essential features of any trading software is its charting capabilities. Modern platforms come equipped with a variety of chart types, including candlestick, bar, and line charts, allowing traders to visualize price movements in multiple ways. This flexibility is important for traders who rely on technical analysis to make informed decisions.

Moreover, these platforms often include a range of technical indicators, such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, which help traders analyze market trends and predict future price movements. Advanced charting software can even enable traders to apply custom indicators, providing a high degree of personalization to their analysis.

Real-Time Market Data and News Integration

To make the most informed decisions, traders need access to real-time market data and news feeds. Modern trading software offers seamless integration with global financial news sources, enabling traders to stay updated on economic events and breaking news that could impact the market.

In addition to news feeds, real-time market data is crucial for executing trades at the right moment. Platforms with real-time quotes allow traders to make decisions based on the most up-to-date information available. This is especially important in fast-moving markets, where even a few seconds can make a significant difference.

Automated Trading Features

One of the most exciting features of modern trading software is the ability to automate trading strategies. Many advanced platforms allow traders to create custom trading algorithms and set them to execute trades automatically based on pre-defined criteria. This feature is particularly useful for traders who want to take advantage of opportunities in the market without having to monitor the charts continuously.

Automated trading can be used for a variety of strategies, from simple rule-based approaches to more complex systems that incorporate machine learning and artificial intelligence (AI). By automating repetitive tasks, traders can free up their time to focus on more strategic decisions and reduce the emotional stress that often comes with manual trading.

Risk Management Tools

Managing risk is an essential part of trading, and modern platforms come with a variety of built-in risk management tools. These tools help traders protect their capital and limit potential losses. Some of the most common risk management features include:

- Stop-loss orders: Automatically close a trade when the price reaches a certain level, preventing excessive losses.

- Take-profit orders: Automatically lock in profits by closing a position when a certain profit level is reached.

- Trailing stops: Adjust the stop-loss level as the market moves in favor of the trade, allowing traders to capture more profits while protecting gains.

These risk management features are essential for maintaining a disciplined trading approach, and they can significantly reduce the likelihood of large, unexpected losses.

Mobile Accessibility

In today’s fast-paced trading environment, the ability to trade on the go is crucial. Many modern trading platforms offer mobile applications that allow traders to monitor their positions, execute trades, and access charting tools directly from their smartphones or tablets.

Mobile trading apps provide the same features as their desktop counterparts, allowing traders to stay connected to the market and make decisions in real time. Whether you’re on the move or away from your computer, mobile access ensures that you never miss an opportunity to capitalize on market movements.

Multi-Asset Trading

Modern trading software often supports multi-asset trading, which allows traders to engage in various financial markets from a single platform. This feature is particularly useful for traders who wish to diversify their portfolios by trading different asset classes, such as currencies, commodities, indices, and cryptocurrencies, all in one place.

By having access to multiple markets, traders can take advantage of different opportunities, manage their risk more effectively, and increase their chances of success. Platforms that support multi-asset trading make it easier for traders to create balanced portfolios and adapt to changing market conditions.

Customizable Interface

A user-friendly, customizable interface is another key feature of modern trading software. Traders can personalize their workspaces to suit their preferences and trading strategies. This could involve adjusting the layout of charts, setting up custom indicators, or creating shortcuts for frequently used tools.

The ability to tailor the interface to your specific needs makes it easier to navigate the platform and execute trades more efficiently. Customization ensures that traders can quickly access the tools they use most, enhancing their overall trading experience.

Cloud-Based Technology

Cloud-based trading platforms offer another significant advantage, providing traders with access to their accounts from any device with an internet connection. This flexibility ensures that traders can manage their portfolios from anywhere, without the need for complex software installations or configurations.

Cloud-based platforms are also typically more secure, as they store data on remote servers with advanced encryption measures. This reduces the risk of data loss and enhances the overall reliability of the platform.

Conclusion

The latest generation of trading software is packed with innovative features that can help traders optimize their performance and make better decisions. From advanced charting and technical analysis tools to real-time data integration, automated trading systems, and risk management features, modern platforms offer everything a trader needs to succeed in today’s fast-paced markets. Platforms like Match-Trader are continuously improving to provide traders with an edge, making it easier to access global markets and implement complex strategies. By embracing these cutting-edge features, traders can enhance their experience and increase their chances of success in the competitive world of trading.